How to Calculate Quick Ratio

If Current Assets Current Liabilities then Ratio is less than 10 - a problem situation at hand as the. Calculate the exposed cylinder volume.

/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)

How To Calculate Acid Test Ratio Overview Formula And Example

This is same as I saw in the research paper.

. Using Excel GCD Function. Learn how to calculate acid-test ratio here. Interpretation of Current Ratios.

How to Calculate Ratio of 3 Numbers in Excel 3 Quick Methods 2. You can now calculate the quick ratio. If the hazard ratio is larger than 1 it means an increased risk of an event across all time points on average while if it is less than 1 there is a reduction in that same risk.

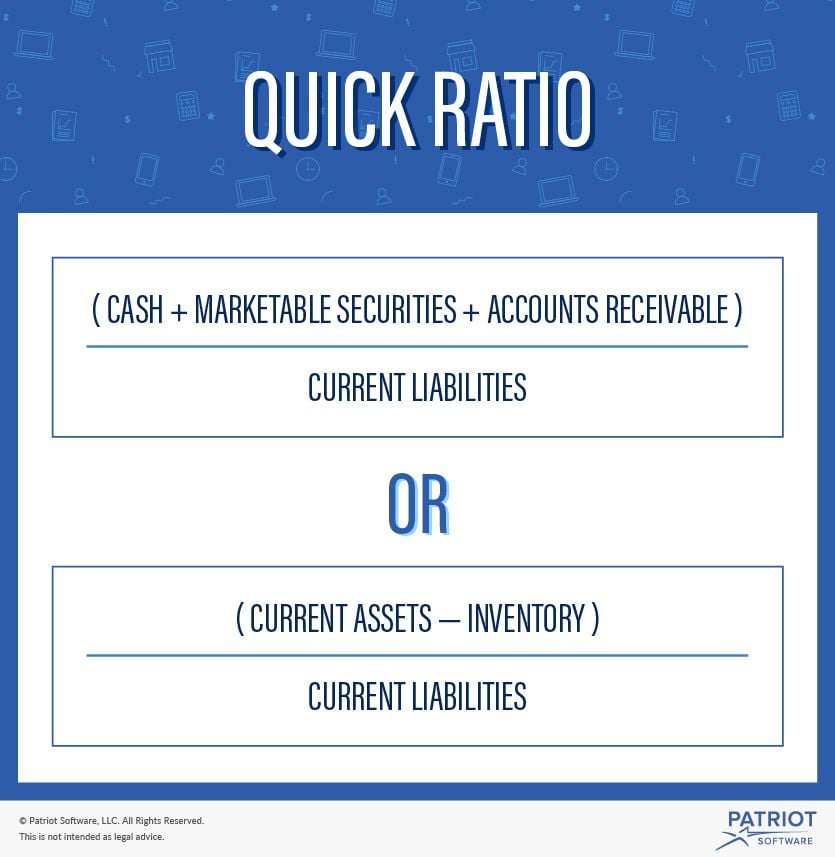

UACR estimates 24-hour urine albumin excretion. The meaning is quite clear. As the calculated acid test ratio Calculated Acid Test Ratio Acid test ratio is a measure of short term liquidity of the firm and is calculated by dividing the summation of the most liquid assets like cash cash equivalents marketable securities or short-term investments and current accounts receivables by the total.

Calculate Ratio with the Help of Ampersand Symbol. It offers an at-a-glance look at the value of a business relative to its debts. Therefore Ratio Quick assets Quick liabilities.

A ratio of 2 suggests that the debtor who buys goods today pays the money after 2. The receivables turnover ratio is an absolute figure normally between 2 to 6. Method 2 of 2.

To calculate dome volume. If Current Assets Current Liabilities then Ratio is greater than 10 - a desirable situation to be in. How to Calculate Sharpe Ratio.

Is proportional to diameter squared which means a ¾ orifice is significantly larger than a ¼ orifice. In this section we will use the Ampersand symbol to determine the ratio. The GCD function returns the greatest common divisor.

An average hazard ratio of 1 indicates no difference in survival rates event rate over time between the two groups being compared on average. It is important to understand the needs of these stakeholders so that the financial statements can be prepared in accordance to those needs. Thank you for reading this guide to understanding the Current Ratio Formula.

The p-value is 0007. Let us understand the crucial external users that matter. Begingroup Unless you have access to the ground truth where you can actually separate the signal and the noise and calculate statistics on that this is an ill posed problem and there is no general solution to that but only domain specific approaches.

The acid-test ratio also known as the quick ratio measures the liquidity of a company. To keep educating yourself and advancing your. First position the piston a measured distance into the cylinder making sure the dome is below the deck.

Lets be honest - sometimes the best quick ratio calculator is the one that is easy to use and doesnt require us to even know what the quick ratio formula is in the first place. And the Odds Ratio is given as 420 and 95 CI is 147-1197 I would like to know how to calculate Odds Ratio and 95 Confidence interval for this. To calculate the total liabilities both short-term and long-term debt is added together to get the total amount in liabilities a company owes.

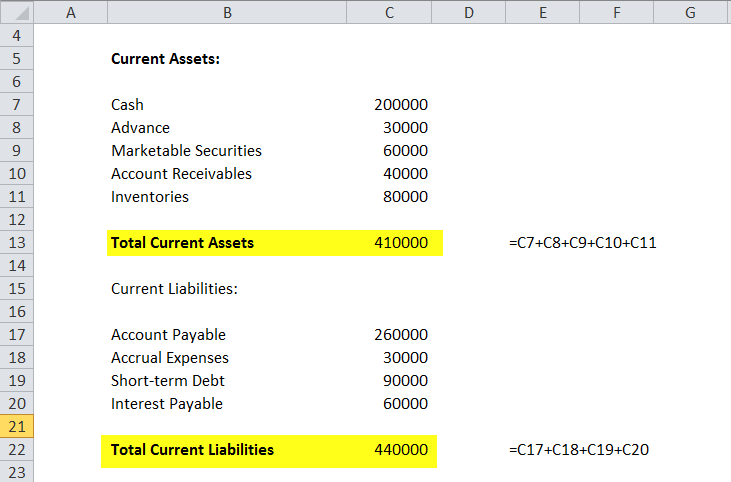

Using the balance sheet totals displayed in Step 2 and Step 3 the numbers you will use to calculate the quick ratio are as follows. In this example the piston is 150-inch in the hole. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6.

Are there any functions. The higher the Sharpe Ratio the better. How to Calculate Quick Ratio.

Find the rotational speed of your drive gear. Interpreting the Quick Ratio. But if you want to know the exact formula for calculating quick ratio then please check out the Formula box above.

The financial statements of an entity are not only prepared for internal users but also for external stakeholders. To calculate the debt to asset ratio you must first analyze the financial balance sheet of your business. UACR is a ratio between two measured substances.

Calculate ZYXs financial basis combined ratio by adding the incurred. Its calculated using the following formula. Lets take a look.

VMAC recently received a message from an engineer who asked how to calculate depressurization time using simple math quick logic. If Current Assets Current Liabilities then Ratio is equal to 10 - Current Assets are just enough to pay down the short term obligations. Also be sure and check out one of our related financial calculators the Treynor Ratio Calculator.

We can calculate the ratio between the two using simple math. That rectangle above shows us a simple formula for the Golden Ratio. 5 Steps for Great Business Writing With Examples How to calculate debt to asset ratio.

Can anyone please tell me how can I calculate this in R. Net Leverage Ratio Net Debt - Cash Holdings EBITDA. The golden ratio is a special number approximately equal to 1618 that appears many times in mathematics geometry art architecture and other areas.

Its just one of several measures along with BMI that your doctor can use to evaluate. Use a spot urine albumin-to-creatinine ratio UACR. A high quick ratio is an indication that a company is utilizing its short-term assets effectively to meet its financial needs.

Below is a video explanation of how to calculate the current ratio and why it matters when performing an analysis of financial statements. This is an active or at least open field of research. Please note this calculator is for educational purposes only and is not a denial or approval.

However note also that 207 3020 43. CFIs Financial Analysis Courses. Waist-to-hip-ratio is a quick and easy way to check how much weight you carry around your middle.

Well help you understand what it means for you. In general the intermediate gear ratios of a gear train will multiply together to equal the overall gear ratio. Volume π x bore radius squared x exposed cylinder height.

The combined ratio is a quick and simple way to measure the profitability and financial health of an insurance company. A Quick Way to Calculate. Twenty-four-hour collection and timed specimens are not necessary.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. To calculate your estimated DTI ratio simply enter your current income and payments. The clothing stores quick ratio is 121 10000 5000 2000 14000.

Note that neither of these are equal to the gear ratio for the entire train 43. Urine Albumin mgdL Urine Creatinine gdL UACR in mgg Albumin excretion in mgday. If a company reports an acid test ratio of 1 this indicates that its quick assets equal its existing.

When the short side is 1 the long side is 12 52 so. Lets be honest - sometimes the best sharpe ratio calculator is the one that is easy to use and doesnt require us to even know what the sharpe ratio formula is in the. Debt-to-equity ratio measures the ratio of a business total liabilities to its stockholders equity.

There are a few data driven methods to determine SNR on a single image.

Quick Ratio Formula Step By Step Calculation With Examples

Quick Ratio Formula And Calculator Excel Template

Quick Ratio Or Acid Test Ratio Double Entry Bookkeeping

Quick Ratio Can You Pay Your Small Business S Liabilities

0 Response to "How to Calculate Quick Ratio"

Post a Comment